An overview of the impact of IDD & GDPR on distribution

An Insurance Provider or an Insurer can no longer work with brokers if the chain defined by the IDD is broken or does not exist.

The responsibility is shared, and the provider/insurance company must check whether contracted brokers comply with the law (Due diligence regarding IDD/GDPR/Anti Bribery & corruption/conflict of interest/product governance/sanctions compliance/fraud or money laundering).

This is the challenge of this industry as we have known banks with a high concentration and Fintech providing technology, licensing, cloud, API, convergence.

What are the most important 10 key points to observe for all intermediaries that we are within the meaning of the law?

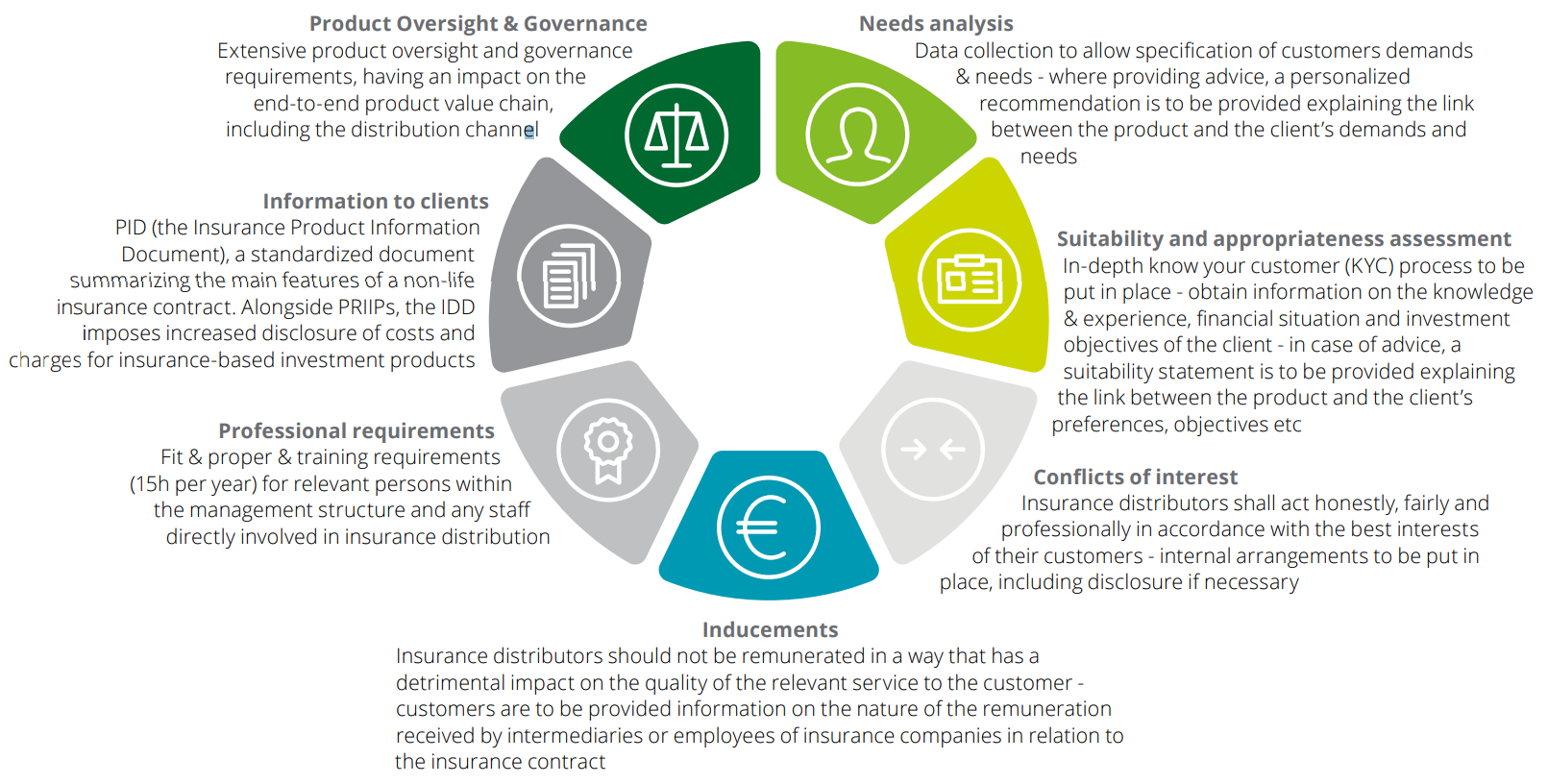

1 - Intermediaries are required to provide greater transparency in the price and benefits of insurance products

2- Intermediaries are required understand and know what the duty of advice and information is

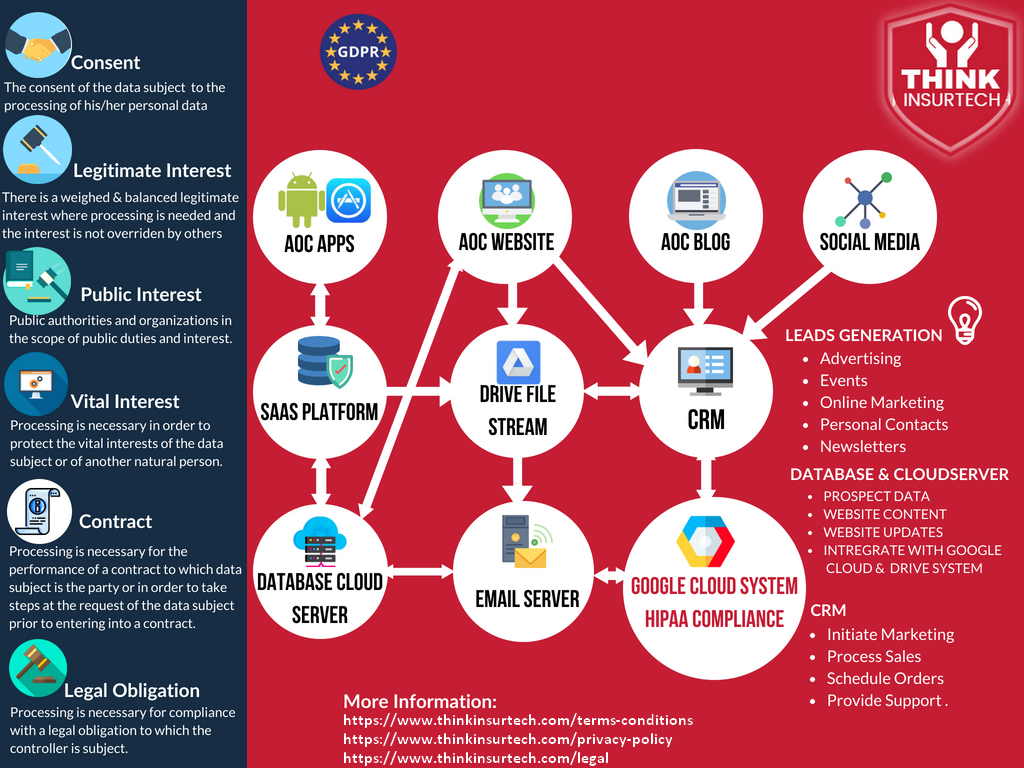

3- Intermediaries are required to prove how they collected data & needs of the insured (clients information, census details, group/life, income protection etc.) and they need to encrypt highly sensitive data*

4- Intermediaries are required to document (data collection/situation/needs/

5- Intermediaries are required to explain/insert in their writing process compulsory and legal mention (Privacy & cookies policy / Term & conditions / Data retention policy) access to the information/where is the data/Where and how are they secure/How you can offer data portability/How to complain to the ombudsman, regulator, the technology (Hosting) **

6- Intermediaries are required to mention their fees or percentage of commissions

7-Intermediaries are required to secure sensitive (medical) data in a HIPAA cloud/or a high security server to be compliant with the GDPR & IDD

8- Intermediaries are required to offer data portability

9- Intermediaries are required to train their staff with a minimum of 15 hours per year (outsourced training)

10- Intermediaries are required to be aware of the distribution directive and sanctions, regulation, remote solicitation and specific rules

Think Insurtech's SaaS modules 100% digitally match all these points with convergence, APIs and cloud to manage sensitive data. Our SaaS platform can connect to any system in plug & play; our system also pushes a mobile application on Google Play and IOS Apple Store.

At Think Insurtech, we are keen to partner with brokers, providers and insurers as technical advisors with deep industry expertise to assist in improving performance and compliance.

Without such a digital platform, brokers lacking expertise or the ability for compliance face a double edge sword; the risk of being dropped by insurers or being fined by EU regulators (up to 10% of revenue). Wielding the sword – the valuation of non-digital brokers is far less than those that are fully digital.

The onset on Covid 19 represents both a challenge and opportunity to become fully digital with the ability to work remotely - seamlessly, engaging clients over video conferencing, with the ability of negotiating and showing plan comparisons in real time.

The reality – non compliant brokers and non-digital players will be forced to exit the market in a very short time frame.

In summary, Think Insurtech's SaaS platform can facilitate the move to digitalization providing an end-to-end plug & play solution - improving sales & distribution, customer service and security.

* Without a suitable environment with plug & play convergence and cloud, it is impossible

** Data must be separated and differentiated in this system with an API to transfer the flow of information

Appendices

*Source Deloitte Insurance distribution directive

*Data flow – How to manage data to be GDPR/IDD compliant